social security tax rate

Fifty percent of a taxpayers benefits may be taxable if they are. Currently many retirees pay taxes on their Social Security benefits.

Tax Amount Increases For 2021 Trueblaze Advisors

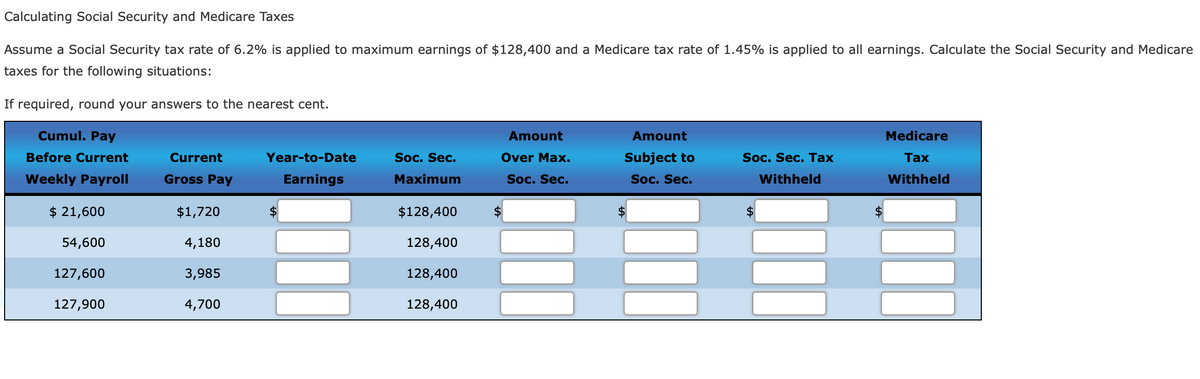

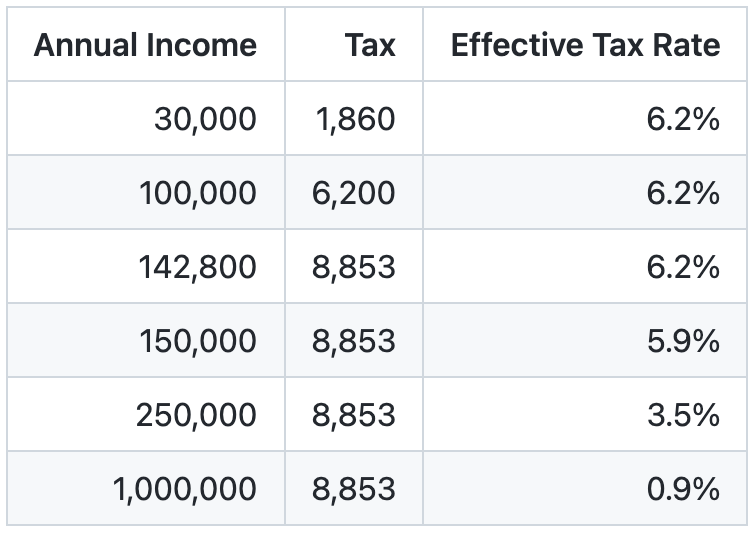

In 2020 employees were required to pay a 62 Social Security tax on income of up to 137700.

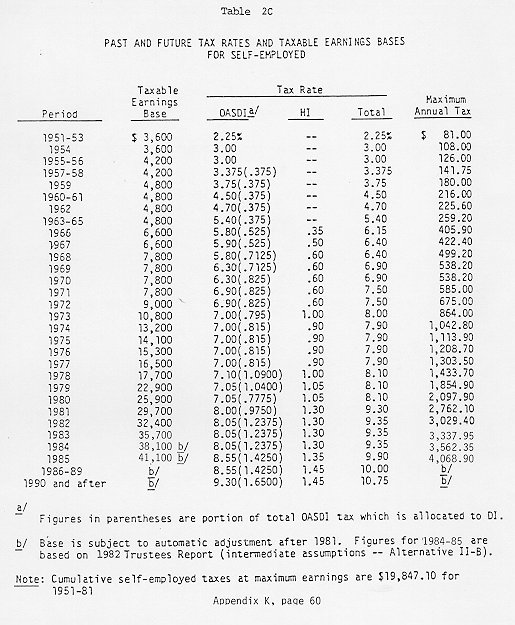

. The 2022 limit for joint filers is 32000. 35 rows OASDI Medicare tax rates Maximum taxable earnings Tax rates for Social. People between the ages of 55 and 64 however can only deduct up to 20000 of Social Security income from their state taxes.

Maximum Taxable Earnings Rose To 142800. West Virginia passed a law in 2019 to begin phasing out taxes on Social Security for those with incomes not exceeding 50000 single filers or 100000 married filing jointly. File a federal tax return as an individual and your combined income.

However if youre married and file separately youll likely have to pay taxes on your Social Security income. The Social Security tax rate for those who are self. Filing single single head of household or qualifying widow or widower with 25000 to 34000 income.

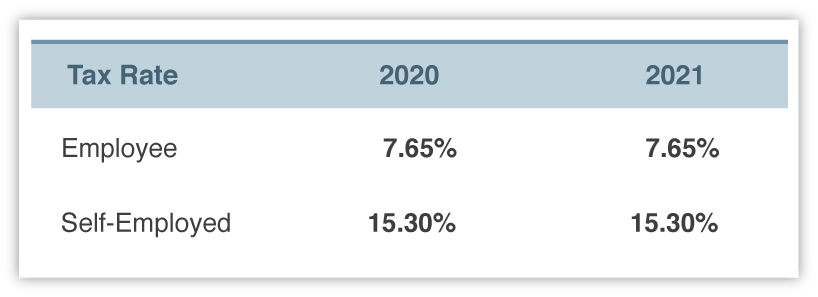

Cut small business taxes. The Social Security tax rate for both employees and employers is 62 of employee compensation for a total of 124. In 2015 the tax rate for Social Security was 62 of an employees income for the employee and employer each or 124 for self-employed workers.

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. A Social Security tax is the tax levied on both employers and employees to fund the Social Security program. You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules.

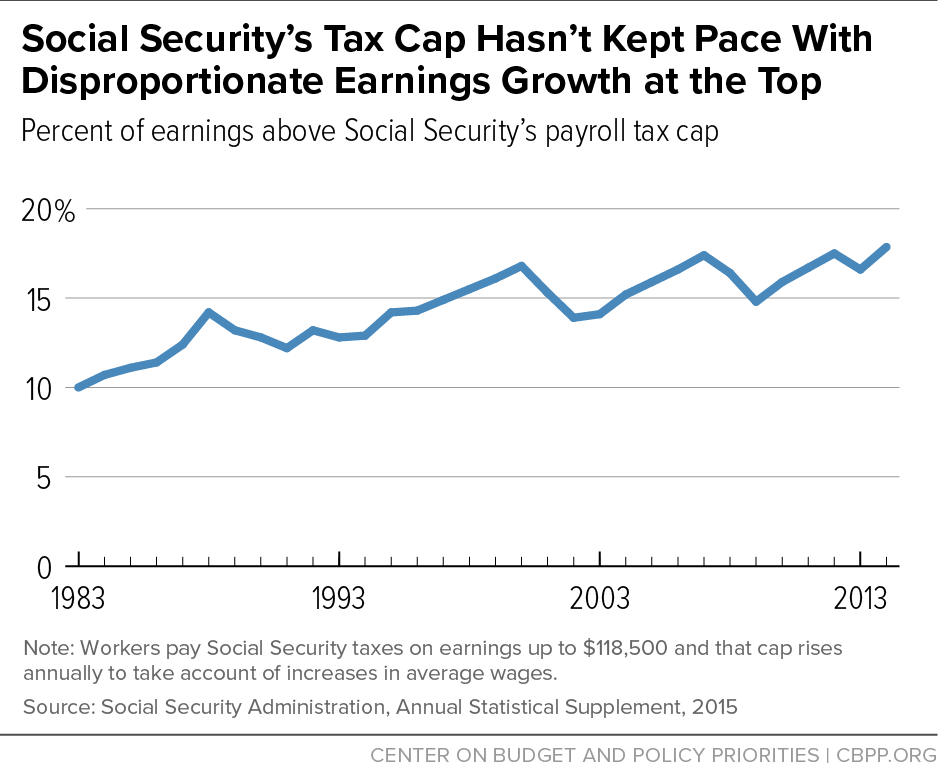

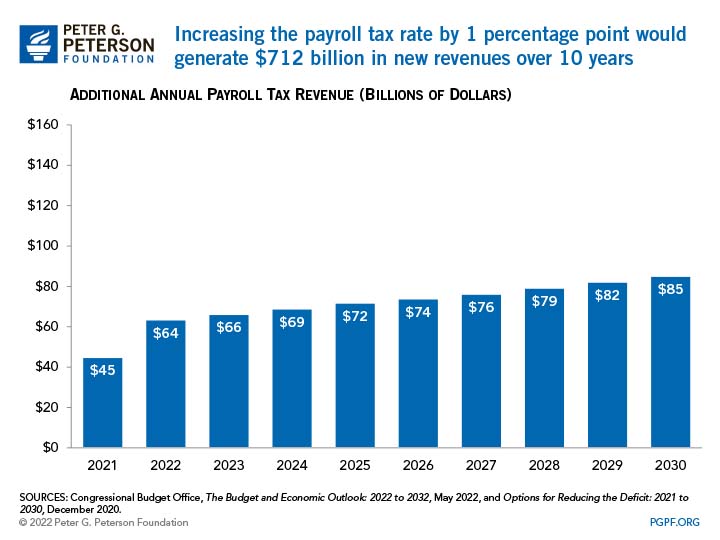

Social Security tax is usually collected in the. A new bill though would get rid of those taxes and make up for the revenue by raising the cap on payroll. These rates have been.

Any earnings above that. The current rate for Medicare is 145 for the employer and 145. Social Security Tax.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Fica Tax What Is Fica Tax Rates Exemptions And Calculations

Social Security Tax Impact Calculator Bogleheads

Social Security Announces 2022 Adjustments Conway Deuth Schmiesing Pllp

Answered Calculating Social Security And Bartleby

Income Limit For Maximum Social Security Tax 2022 Financial Samurai

Social Security Reform Options To Raise Revenues

The Evolution Of Social Security S Taxable Maximum

Research Income Taxes On Social Security Benefits

The Taxation Of Social Security Benefits Congressional Budget Office

Excel Business Math 34 Median Function For Fica Social Security Medicare Payroll Deductions Youtube

Social Security What Is A Regressive Tax By Jarrett Meyer Medium

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Taxes And Social Security In 2020 Everything You Need To Know Simplywise

2021 Social Security Changes Announced Appletree Business

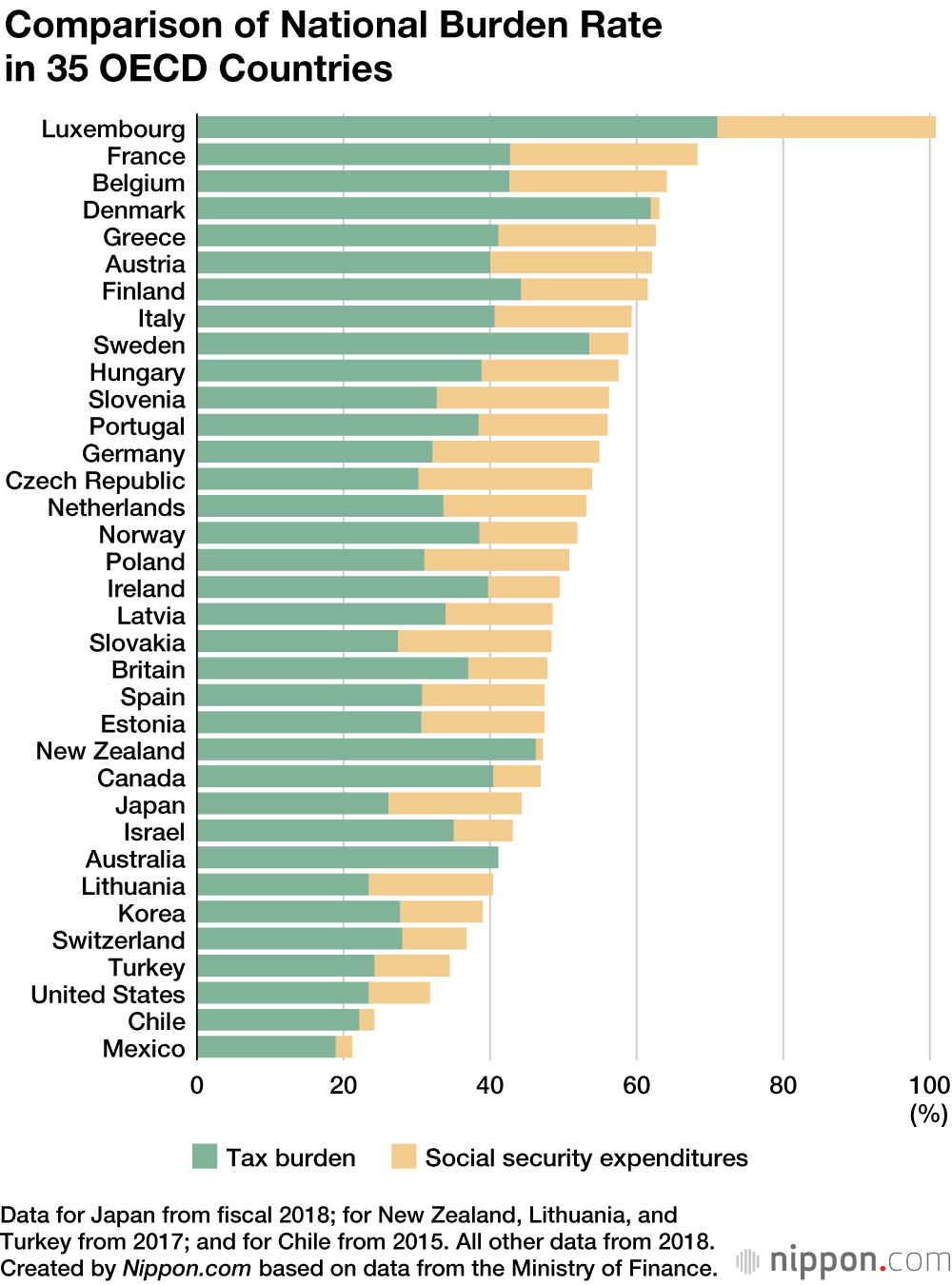

National Burden Taxes And Social Security Contributions In Japan Exceed 40 Of Income For Ninth Consecutive Year Nippon Com

Maximum Ss Taxes Have Increased 4x Since 1970 American Enterprise Institute Aei